CardTraq is an analytics platform to optimize card scheme fees, interchange, and compliance.

Payment card schemes continuously update their pricing and compliance requirements.

Staying current is a time-consuming and laborious process, but failure to do so can incur significant hits to profitability.

Scheme-driven costs represent a substantial savings opportunity for issuers, acquirers, & BIN sponsors.

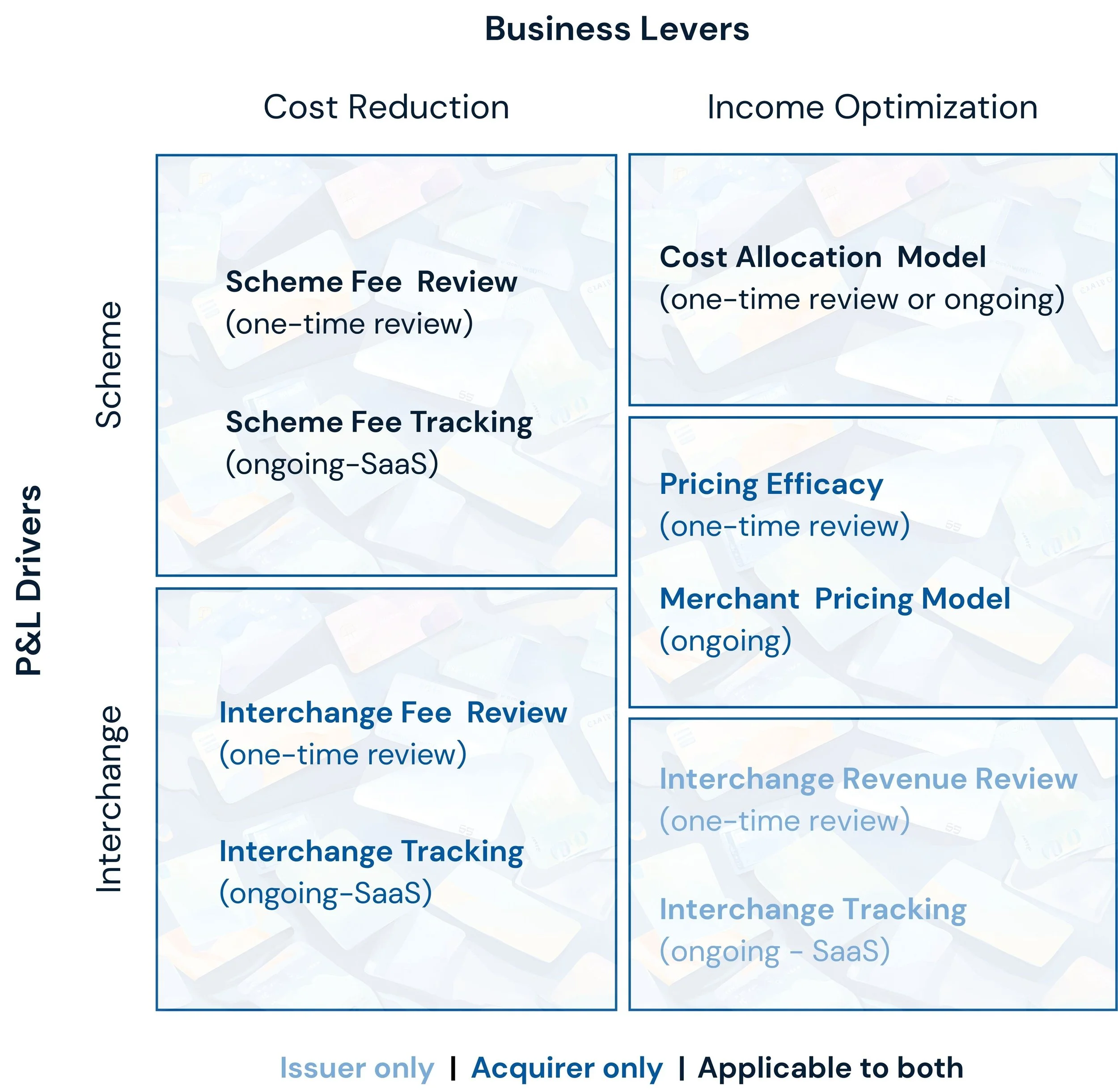

We focus on two broad P&L drivers…

Interchange

Scheme Fees

…and two levers to maximize profitability and competitiveness:

Cost Reduction

Income Optimization

We typically identify potential scheme fee savings of 10-20%, interchange fee reduction of 5-10%, and improve cost recovery by up to 50%.

Our offerings are relevant to all types of card - credit, debit, prepaid, payroll, commercial - as long as they are Visa or Mastercard branded

Scheme Fee Tracking

Effortlessly understand, control, compare and forecast your costs.

Saving our clients millions in scheme fees, every year.

Interchange Tracking

Gain detailed visibility into interchange drivers & improvement levers.

Strengthen P&L control, support better strategic decision-making and forecasting accuracy.

Compliance Tracking

Proactively manage card scheme updates – all in one place.

Help your teams stay compliant, aligned, and efficient.

Custom Services

Additionally, we offer tailored profitability engagements, leveraging our expert practitioners, through our consulting organization.

Our experts have supported many of the world's leading payments organizations

“Before CardTraq, scheme fees were a black box. Now, we have a clear monthly view of every charge, and can challenge unexpected items with confidence. We’ve already saved seven figures and strengthened our merchant pricing.”

COO, Mid-Sized Acquirer

“CardTraq helped us uncover hidden fees and gave us the transparency we needed to streamline our cost structure. It’s rare to find a tool this powerful that’s also this easy for a bank to use.”

Head of Product & Ops, Digital-First Issuer

“CardTraq turned fee optimization from a manual slog into a strategic advantage. We now track trends across multiple regions and products, spot anomalies early, and make more informed decisions.”

CFO, Global Issuer

Ready to optimize your scheme fees?

Our team of seasoned experts is here to help you gain control of your payment card costs. Let us show you how CardTraq can optimize your compliance and scheme fee management to deliver significant savings.

Book a demo or contact us for a personalized consultation.