From Invoice to Forecast: How to Build a Card Network (Scheme) Fee Model

If network (scheme) fees keep “surprising” you, you don’t have a fee model.

You have an invoice.

Invoices explain the past. CFOs and product leaders need the next 30–90 days.

Because network fees hit profitability before anyone has time to react.

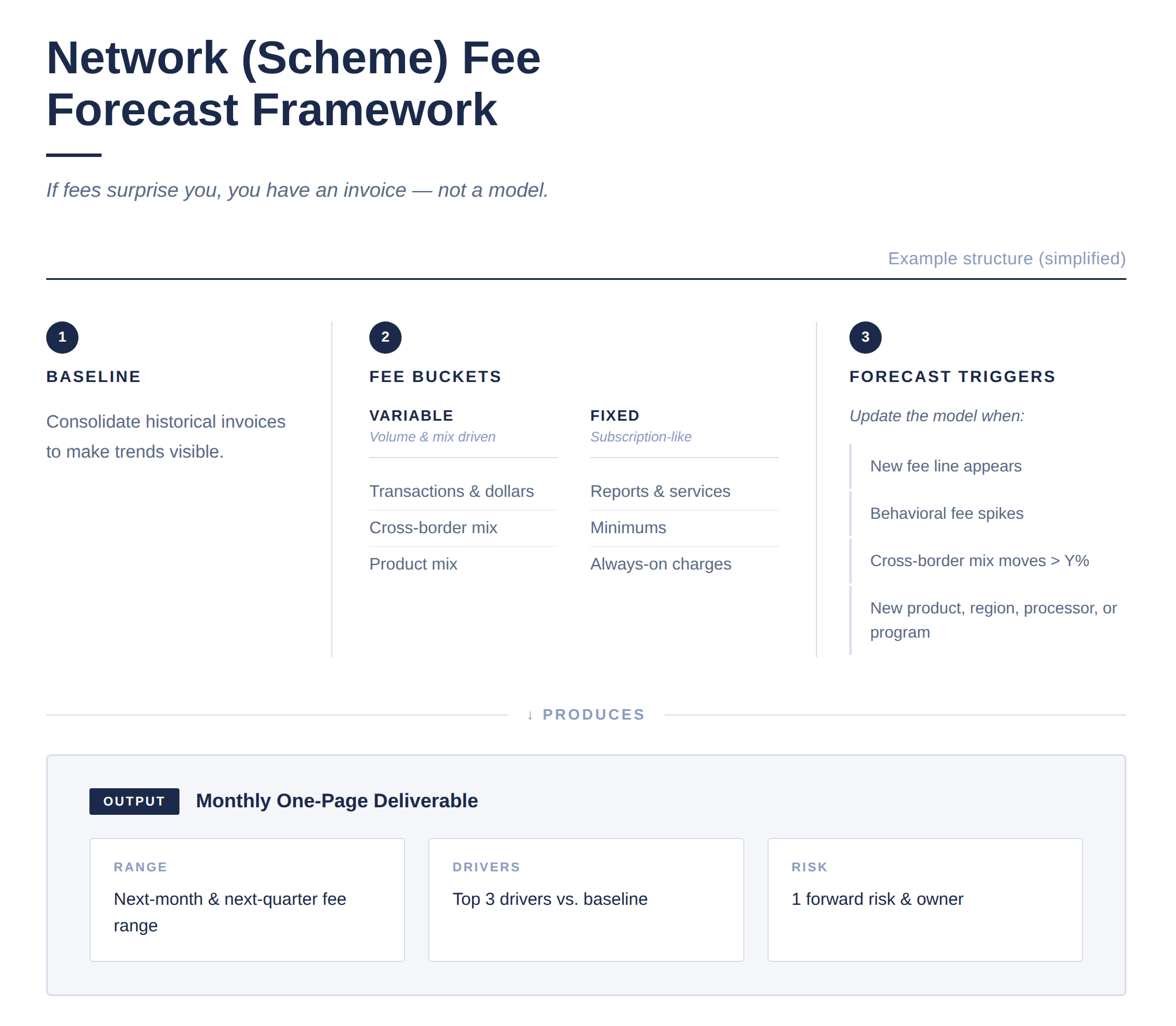

I put the cheat sheet in the graphic.

The only point I’ll add here: you don’t get a forecast until you baseline.

If you can’t consolidate historical invoices into something you can trend, you’ll always be reacting.

Are network (scheme) fees a forecast in your org, or still a month-end explanation?