Interchange for Issuers

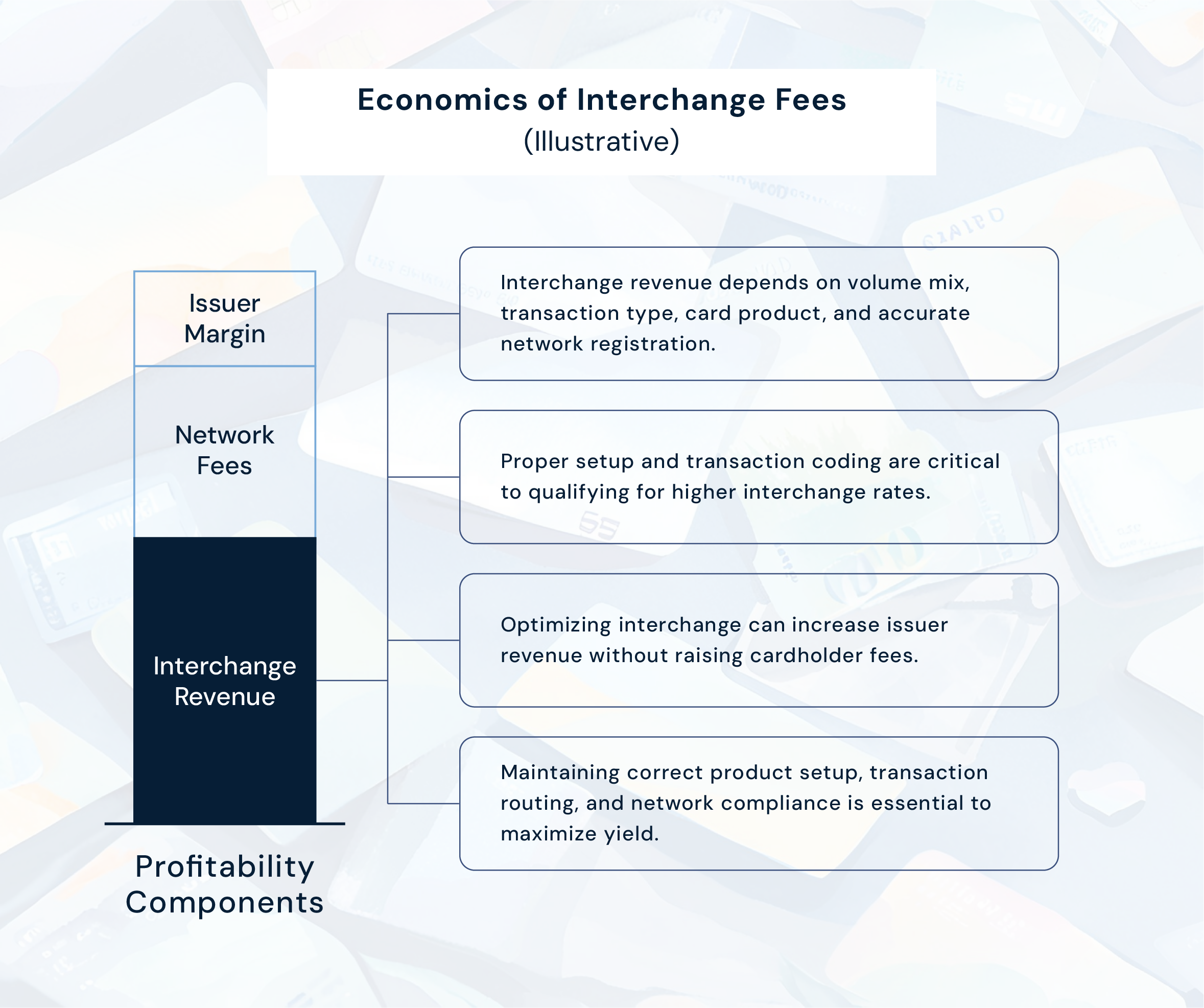

Interchange represents a major, often under-optimized revenue stream for card issuers.

Frequent interchange rate changes and shifting cardholder behaviors can quietly erode revenue.

Manual tracking leaves issuers exposed to missed risks and upgrade opportunities.

Forecasting interchange revenue becomes difficult without active tracking.

Substantial interchange revenue can typically be captured through closer tracking and analysis.

There are multiple levers we can pull for Interchange Optimization

Our interchange tracking platform is a cloud-based tool, which helps issuers optimize revenue with minimal effort.

The platform ingests clearing data and provides detailed visibility into customer spend and interchange revenue across products, networks, and merchant categories, helping issuers:

Protect current revenue: Spot unfavorable changes early and act quickly

Capture growth: Identify product upgrade opportunities and marketing targets.

Enhance Forecasting: Provide finance and strategy teams with better interchange revenue predictions.

Safeguard revenue and unlock growth with detailed tracking and actionable insights.

Our Interchange Tracking Platform is cloud-based and features:

Daily, weekly, monthly ingestion of clearing data & volumetrics

Automated detection of sub-optimal interchange outcomes and missed qualification opportunities.

Extensive reporting and analytics to support interchange revenue optimization and portfolio strategy.

Interchange yield analysis by portfolio segment, spend category, card product, geography, and channel.

Visibility into spend and interchange patterns to support product upgrade opportunities.

CardTraq — created in partnership with Pinnacle Payment Economics — is based on over 100 years of card network economic and real-world compliance experience.

Our experts can work alongside your team to identify and implement savings opportunities and ensure you get the maximum value from the CardTraq platforms.

Ready to optimize your network fees?

Our team of seasoned experts is here to help you gain control of your payment card costs. Let us show you how CardTraq can optimize your compliance and network fee management to deliver significant savings.

Book a demo or contact us for a personalized consultation.