Optimiza la rentabilidad de tus tarjetas con insights accionables sobre tarifas de red e interchange.

Las redes de tarjetas actualizan continuamente sus precios y requisitos de cumplimiento.

Mantenerse al día es un proceso largo y complejo, pero no hacerlo puede afectar gravemente la rentabilidad..

Savings opportunities identified to date in 2025

Los costos de red representan una importante oportunidad de ahorro para emisores, adquirentes y Patrocinadores BIN.

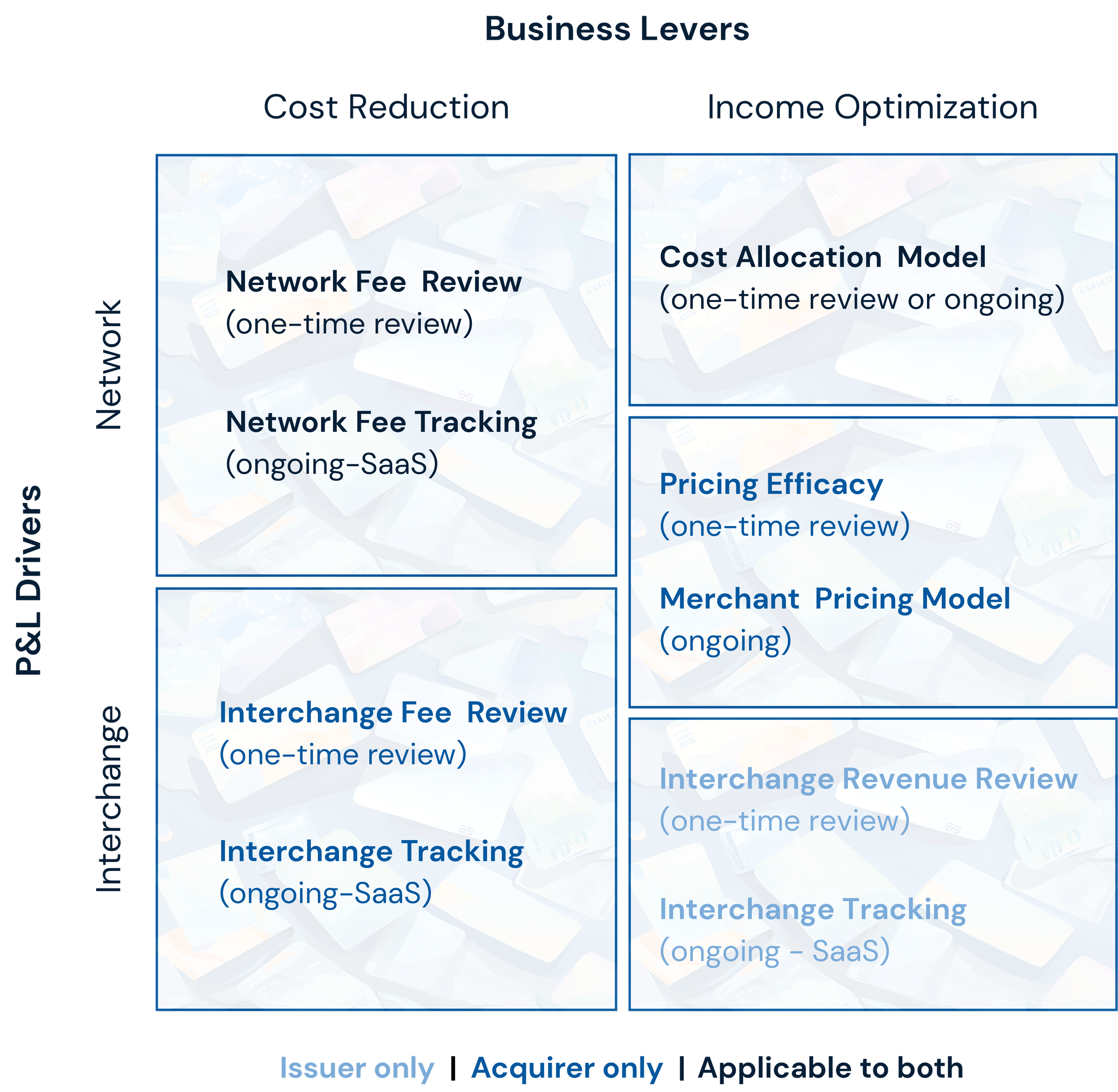

Nos enfocamos en dos grandes impulsores del P&L…

Interchange

Tarifas de Red

…y en dos palancas para maximizar la rentabilidad y competitividad:

Reducción de Costos

Optimización de Ingresos

Típicamente, ahorramos a nuestros clientes entre un 10-20% en tarifas de red, un 5-10% en tarifas de interchange, y aumentamos la recuperación de costos hasta en un 50%.

Nuestras soluciones son relevantes para cualquier tipo de tarjeta — crédito, débito, prepago, nómina, comercial — siempre que estén bajo la marca Visa o Mastercard.

Monitoreo de Tarifas de Red

Comprende, controla, compara y proyecta tus costos sin esfuerzo.

Ahorramos millones a nuestros clientes cada año en tarifas de red.

Monitoreo de Interchange

Accede a una visibilidad detallada de los impulsores del interchange y cómo mejorarlos.

Mejora el control del P&L, apoya decisiones estratégicas y mejora la precisión del forecast.

Servicios

Además, ofrecemos asesoría personalizada sobre rentabilidad de tarjetas a través de nuestro equipo experto de consultoría..

Nuestros expertos han apoyado a muchas de las principales organizaciones de pagos del mundo

“Antes de CardTraq, las tarifas de red eran una caja negra. Ahora tenemos una vista clara mensual de cada cargo y podemos impugnar partidas inesperadas con confianza. Ya hemos ahorrado siete cifras y fortalecido nuestro pricing para comercios.”

COO, Adquirente Mediano

“CardTraq nos ayudó a descubrir tarifas ocultas y nos dio la transparencia que necesitábamos para optimizar nuestra estructura de costos. Es raro encontrar una herramienta tan potente y tan fácil de usar para un banco.”

Director/a de Producto y Operaciones, Emisor Digital

“CardTraq turned fee optimization from a manual slog into a strategic advantage. We now track trends across multiple regions and products, spot anomalies early, and make more informed decisions.”

CFO, Emisor Digital